Financial management is rarely quite as straightforward as it sounds‚ the complexity of budgeting combined with monitoring expenditure being tough‚ tiring and tortuous even at the best of times. Thankfully‚ though‚ some brilliant apps can make the process easier. Here‚ we look at some of the best currently on the market.

Nature of financial apps

Financial apps can be classified into three distinct categories: Financial managers‚ which help users get an overview of their income‚ savings and general expenditure; Debt control management apps for keeping track of credit card spending and offering insights into debt; and Investment portfolio apps‚ which help people make the most of money invested in the likes of stocks. We’ve picked two from each to explore in greater depth; all have featured repeatedly on top financial websites as well as media platforms‚ drawing positive user reviews.

Financial managers

MintMint‚ which is available on iOS and Android‚ is among the best financial managers currently on offer. The mobile app lets users link up multiple bank accounts and credit cards‚ providing detailed information‚ categorising expenses and sending out alerts should budgets be exceeded. The web-based version also enables simple movement of cash between accounts and draws up spending forecasts. It even offers saving tips. A solid user interface – with intuitive charts‚ graphs and displays – has likewise helped the tool maintain its strong reputation.WallyExpense tracking is crucial when it comes to saving money – which is where Wally comes in. The app offers users a detailed breakdown of where their cash is going‚ dividing this into categories that can be modified to individual preference. It also scans receipts (meaning there is no need for manual input)‚ enables the setting of saving goals and alerts users before particular ongoings are due. This free mobile app is available on both iOS and Android.

![[object Object] [object Object]](http://images.ctfassets.net/o6514hijae09/3esXyrWICkYsBPjbkXuLk/d3a284ef6c31068225b8be73566adbe9/mint_wally_app_on_smartphones.jpg)

Debt control Apps

Credit KarmaWith a user base of 32m subscribers across the globe and a valuation of over $1bn‚ Credit Karma is a serious player in the world of debt control apps. The tool provides weekly credit reports and credit scores for users‚ helping them take control of spending by allowing them to link their credit cards as well as their bank accounts.

WallabyIn a similar vein to Credit Karma‚ Wallaby helps users track credit card expenditure. The app‚ however‚ goes one step further by offering advice on in-store spending‚ helping reduce interest rates following large purchases. It also helps users make the most of potential credit card rewards and alerts them of any suspicious activity taking place within their accounts. The app is available for free on both iOS and Android.

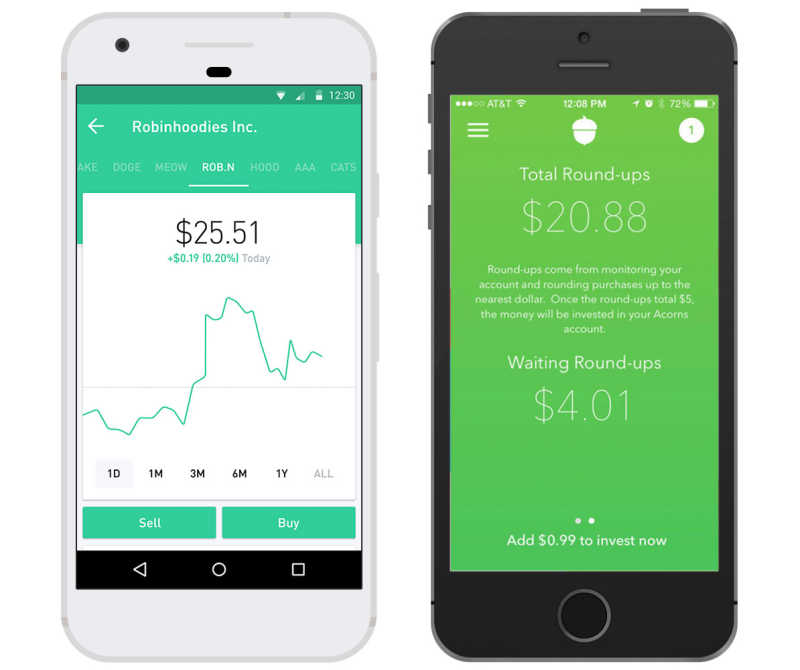

Investment Portfolio AppsRobinhoodFinancial literacy is a prerequisite for any first-time investor‚ but‚ with Robinhood‚ the process is made considerably easier. A commission-free trading platform‚ it lets users trade more than 5‚000 stocks or exchange-traded funds (ETFs) and even offers $0 trading on initial sessions. On the downside‚ the free version lacks the advanced trading tools major brokers offer – but millennials‚ in particular‚ will likely enjoy its ease of use.AcornsAnother good app for those looking to get started on the stock market‚ Acorns allows users to link up credit and debit cards to invest in a diversified portfolio of index funds. As the company’s co-founder and COO‚ Jeff Cruttenden put it: “It is designed for new and experienced investors who want a quick‚ easy and automatic way to invest their money. People can get started in seconds; then set it and forget it.” The app‚ however‚ does charge a small fee for the service – usually a percentage of the user’s account balance.

Overall‚ we believe financial apps should be easy to use and‚ just as crucially‚ provide users with genuine help in solving their money problems. Those featured above aim to do just that – so why not give them a go?

References :

– 10 Best Apps for Timid First-Time Investors

– The Best Mobile Finance Apps of 2017

– 10 Awesome Apps For Investors And Wall Streeters On The Road

– The Best New Personal Finance Apps And Sites